As I am getting married there has been some talk of buying a house. So, I decided to repeat some calculations in every local market I might end up buying in.

I take the position that because median incomes have stagnated during the past decade while a huge number of homes were built and unemployment skyrocketed there is no fundamental reason for home prices to be any higher than they were in 2000. I therefore expect that they will drop to that level, either through further price drops or inflation. Also, because interest rates have been so low they have nowhere to go but up. This will also drive prices lower.

So, I decided to see just how far above 2000 prices houses in my area remain. I looked up 2000 median home prices from the U.S. Census, and current home prices from Zillow.com. From those numbers I came up with the following numbers for how overpriced homes are:

Brea

2000 $261,700

Inf adj 2000 $332,000

Current $476,000

Amount Overpriced: $135,000

Percent Overpriced: 41%

Fullerton

2000 $241,900

Inf adj 2000 $307,000

Current $432,900

Amount Overpriced: $126,000

Percent Overpriced: 41%

Rosemead

2000 $182,200

Inf adj 2000 $231,000

Current $387,000

Amount Overpriced: $156,000

Percent Overpriced: 68%

Alhambra

2000 $210,400

Inf adj 2000 $267,000

Current $451,000

Amount Overpriced: $184,000

Percent Overpriced: 69%

Covina

2000 $189,500

Inf adj 2000 $241,000

Current $337,000

Amount Overpriced: $96,000

Percent Overpriced: 40%

West Covina

2000 $190,200

Inf adj 2000 $242,000

Current $361,000

Amount Overpriced: $119,000

Percent Overpriced: 49%

Walnut

2000 $279,700

Inf adj 2000 355,000

Current $556,000

Amount Overpriced: $201,000

Percent Overpriced: 57%

Diamond Bar

2000 $245,800

Inf adj 2000 $312,000

Current $44700

Amount Overpriced: $135,000

Percent Overpriced: 43%

Yorba Linda

2000 $346,100

Inf adj 2000 $440,000

Current $607,200

Amount Overpriced: $167,000

Percent Overpriced: 38%

Corona

2000 $194,400

Inf adj 2000 $247,000

Current $327,000

Amount Overpriced: $80,000

Percent Overpriced: 32%

Chino

2000 $173,600

Inf adj 2000 $220,000

Current $300,000

Amount Overpriced: $80,000

Percent Overpriced: 36%

Chino Hills

2000 $242,600

Inf adj 2000 $308,000

Current $462,000

Amount Overpriced: $154,000

Percent Overpriced: 64%

Placentia

2000 $264,500

Inf adj 2000 $336,000

Current $469,000

Amount Overpriced: $133,000

Percent Overpriced: 40%

San Dimas

2000 $232,400

Inf adj 2000 $295,000

Current $406,000

Amount Overpriced: $111,000

Percent Overpriced: 37%

Claremont

2000 $251,000

Inf adj 2000 $319,000

Current $487,000

Amount Overpriced: $168,000

Percent Overpriced: 67%

So, to make buying a home worthwhile someone would need to give me at least a hundred twenty thousand dollars which could not be used for any other purpose. Even then it could be a bad investment. After all, there is nothing magical about 2000 prices. After all, we just had a lot of construction at a time without a whole lot of population growth. Prices could always drop to 1997 levels which were a fair bit lower than the ones I am comparing to. I am just using 2000 levels since I can't see a real reason why prices will stay 40-70% above these levels.

It should be noted that this is not just true in Southern California. Nationwide housing prices are still 58% above what they were in 2000. So expect the bust to continue for quite some time.

Tuesday, December 28, 2010

Case Shiller Graph Updated to July 2010

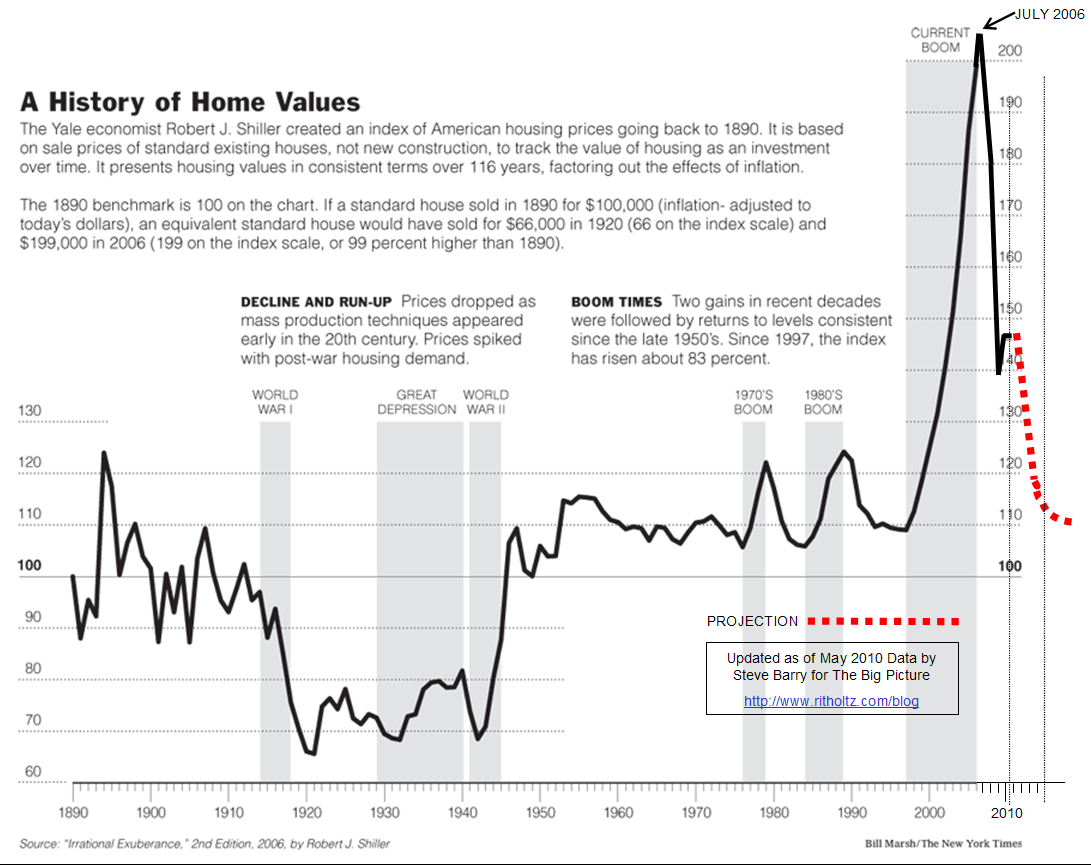

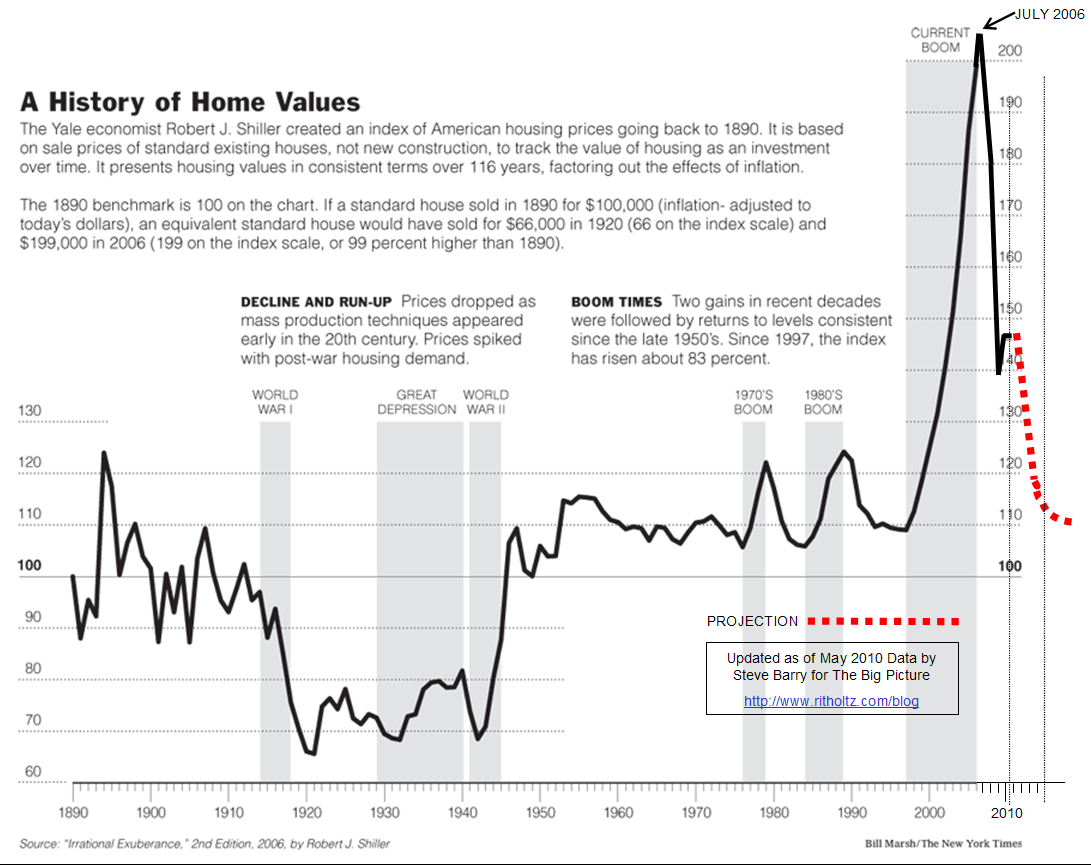

My prediction of inflation adjusted 2000 home prices being where we are going was strongly influenced by an older version of this chart:

It was updated by a blogger to include a few more years of data. As you can clearly see, the end of a bubble is home prices right about the same as the start. So we are about two thirds the way through the crash. Although prices don't seem to stay at the bottom for long, a couple years is typical. The only long term deviation from this was the great depression.

Edit: I just ran into an article showing a slightly newer version of this graph.

It was updated by a blogger to include a few more years of data. As you can clearly see, the end of a bubble is home prices right about the same as the start. So we are about two thirds the way through the crash. Although prices don't seem to stay at the bottom for long, a couple years is typical. The only long term deviation from this was the great depression.

Edit: I just ran into an article showing a slightly newer version of this graph.

Saturday, December 18, 2010

PHD Supply and Demand

Another article about the PhD job market. It always cheers me up now that I have a job which pays so much better than post doc positions.

Buchanan Wrestling

For the second time since I was in high school, the wrestling team I spent three seasons as a whipping boy for is in national news. The first time was when two fairly talented former wrestlers from my high school class were blown up by the same bomb. Now, one member of the team is pressing sexual assault charges against another member of the team for a move he did during a practice.

Unless things have gone way down hill since I was there, or this particular wrestler was going way beyond anything I ever saw(which from the description I doubt), I am inclined to think the freshman needs to take up chess. It is a full contact sport, and one where very limited numbers of moves are off limits. Many things done on wrestling mats would very clearly get you an assault charge if done on the street. So what? Within a week you know exactly what you are in for, if it isn't for you than just stop going to practice.

Unless things have gone way down hill since I was there, or this particular wrestler was going way beyond anything I ever saw(which from the description I doubt), I am inclined to think the freshman needs to take up chess. It is a full contact sport, and one where very limited numbers of moves are off limits. Many things done on wrestling mats would very clearly get you an assault charge if done on the street. So what? Within a week you know exactly what you are in for, if it isn't for you than just stop going to practice.

Subscribe to:

Posts (Atom)